Does Virginia Have A Real Estate Transfer Tax . on every deed admitted to record, except a deed exempt from taxation by law, there is hereby levied a state. the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax stamp). Virginia imposes a real estate transfer tax on the sale of real property. the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. virginia's current transfer tax rate is usually $3.50 per $1,000. a real estate transfer tax is a fee you pay to a state, county, or municipality for “the privilege of. So, for a house worth $395,685 — the median home price in the state —. real estate transfer tax: Virginia’s transfer tax, which covers the transfer of property ownership, is complicated.

from formspal.com

real estate transfer tax: virginia's current transfer tax rate is usually $3.50 per $1,000. So, for a house worth $395,685 — the median home price in the state —. Virginia imposes a real estate transfer tax on the sale of real property. on every deed admitted to record, except a deed exempt from taxation by law, there is hereby levied a state. the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. Virginia’s transfer tax, which covers the transfer of property ownership, is complicated. a real estate transfer tax is a fee you pay to a state, county, or municipality for “the privilege of. the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax stamp).

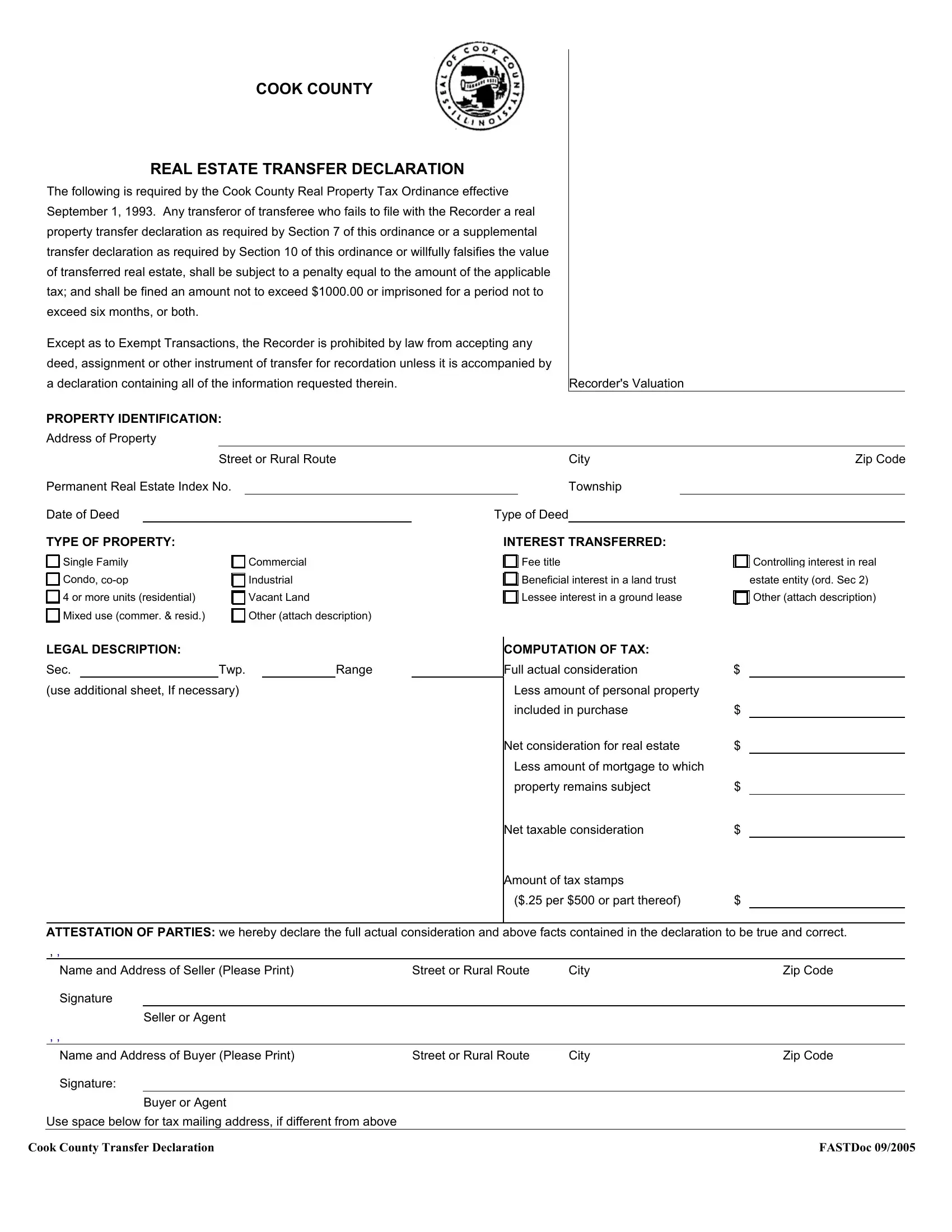

Real Estate Transfer Declaration PDF Form FormsPal

Does Virginia Have A Real Estate Transfer Tax the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax stamp). a real estate transfer tax is a fee you pay to a state, county, or municipality for “the privilege of. on every deed admitted to record, except a deed exempt from taxation by law, there is hereby levied a state. So, for a house worth $395,685 — the median home price in the state —. Virginia imposes a real estate transfer tax on the sale of real property. real estate transfer tax: virginia's current transfer tax rate is usually $3.50 per $1,000. Virginia’s transfer tax, which covers the transfer of property ownership, is complicated. the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax stamp). the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of.

From lukinski.com

Real Estate Transfer Tax Hidden Additional Cost Explained ℄ Real Estates Does Virginia Have A Real Estate Transfer Tax virginia's current transfer tax rate is usually $3.50 per $1,000. real estate transfer tax: the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax stamp). Virginia imposes a real estate transfer tax on the sale of real property. a real estate transfer tax is a. Does Virginia Have A Real Estate Transfer Tax.

From www.formsbank.com

Form Est80 Virginia Estate Tax Return printable pdf download Does Virginia Have A Real Estate Transfer Tax Virginia’s transfer tax, which covers the transfer of property ownership, is complicated. Virginia imposes a real estate transfer tax on the sale of real property. the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. virginia's current transfer tax rate is usually $3.50 per. Does Virginia Have A Real Estate Transfer Tax.

From www.nber.org

Transfer Taxes and the Real Estate Market NBER Does Virginia Have A Real Estate Transfer Tax So, for a house worth $395,685 — the median home price in the state —. Virginia imposes a real estate transfer tax on the sale of real property. Virginia’s transfer tax, which covers the transfer of property ownership, is complicated. the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price. Does Virginia Have A Real Estate Transfer Tax.

From www.forbes.com

What Are Real Estate Transfer Taxes? Forbes Advisor Does Virginia Have A Real Estate Transfer Tax Virginia’s transfer tax, which covers the transfer of property ownership, is complicated. Virginia imposes a real estate transfer tax on the sale of real property. the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. virginia's current transfer tax rate is usually $3.50 per. Does Virginia Have A Real Estate Transfer Tax.

From www.theoldfathergroup.com

Real Estate Transfer Tax What Are They & Where Does The Money Go Does Virginia Have A Real Estate Transfer Tax Virginia imposes a real estate transfer tax on the sale of real property. the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax. Does Virginia Have A Real Estate Transfer Tax.

From cemxirmg.blob.core.windows.net

Virginia Real Estate Transfer Tax at Eric Lyons blog Does Virginia Have A Real Estate Transfer Tax So, for a house worth $395,685 — the median home price in the state —. the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax stamp). a real estate transfer tax is a fee you pay to a state, county, or municipality for “the privilege of. . Does Virginia Have A Real Estate Transfer Tax.

From cemxirmg.blob.core.windows.net

Virginia Real Estate Transfer Tax at Eric Lyons blog Does Virginia Have A Real Estate Transfer Tax the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. virginia's current transfer tax rate is usually $3.50 per $1,000. real estate transfer tax: Virginia’s transfer tax, which covers the transfer of property ownership, is complicated. on every deed admitted to record,. Does Virginia Have A Real Estate Transfer Tax.

From www.cbpp.org

29 States Plus D.C. Have Real Estate Transfer Taxes or Statewide Property Taxes Center on Does Virginia Have A Real Estate Transfer Tax the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax stamp). on every deed admitted to record, except a deed exempt from. Does Virginia Have A Real Estate Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Westchester County? Does Virginia Have A Real Estate Transfer Tax the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. on every deed admitted to record, except a deed exempt from taxation by law, there is hereby levied a state. So, for a house worth $395,685 — the median home price in the state. Does Virginia Have A Real Estate Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Los Angeles? Does Virginia Have A Real Estate Transfer Tax Virginia’s transfer tax, which covers the transfer of property ownership, is complicated. a real estate transfer tax is a fee you pay to a state, county, or municipality for “the privilege of. the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. virginia's. Does Virginia Have A Real Estate Transfer Tax.

From www.gatewaytax.ca

Understanding The Property Transfer Tax 2023 Does Virginia Have A Real Estate Transfer Tax the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. So, for a house worth $395,685 — the median home price in the state —. Virginia’s transfer tax, which covers the transfer of property ownership, is complicated. a real estate transfer tax is a. Does Virginia Have A Real Estate Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Westchester County? Does Virginia Have A Real Estate Transfer Tax Virginia’s transfer tax, which covers the transfer of property ownership, is complicated. virginia's current transfer tax rate is usually $3.50 per $1,000. the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax stamp). So, for a house worth $395,685 — the median home price in the state. Does Virginia Have A Real Estate Transfer Tax.

From dokumen.tips

(PDF) REAL PROPERTY TRANSFER TAX DECLARATION … · REAL PROPERTY TRANSFER TAX DECLARATION (Form Does Virginia Have A Real Estate Transfer Tax So, for a house worth $395,685 — the median home price in the state —. a real estate transfer tax is a fee you pay to a state, county, or municipality for “the privilege of. real estate transfer tax: the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion. Does Virginia Have A Real Estate Transfer Tax.

From azexplained.com

Are Real Estate Transfer Taxes Deductible? AZexplained Does Virginia Have A Real Estate Transfer Tax virginia's current transfer tax rate is usually $3.50 per $1,000. the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax stamp). Virginia’s transfer tax, which covers the transfer of property ownership, is complicated. the virginia state transfer tax is levied at a rate of $0.25 cents. Does Virginia Have A Real Estate Transfer Tax.

From www.formsbirds.com

Real Property Transfer Tax Return Free Download Does Virginia Have A Real Estate Transfer Tax real estate transfer tax: Virginia’s transfer tax, which covers the transfer of property ownership, is complicated. Virginia imposes a real estate transfer tax on the sale of real property. the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax stamp). So, for a house worth $395,685 —. Does Virginia Have A Real Estate Transfer Tax.

From dxouejlul.blob.core.windows.net

Real Estate Transfer Tax Turkey at Rex Dietrich blog Does Virginia Have A Real Estate Transfer Tax So, for a house worth $395,685 — the median home price in the state —. a real estate transfer tax is a fee you pay to a state, county, or municipality for “the privilege of. the state of virginia has three transfer taxes and two recordation taxes (think of the recordation tax as a mortgage tax stamp). . Does Virginia Have A Real Estate Transfer Tax.

From www.youtube.com

What is real estate transfer tax? YouTube Does Virginia Have A Real Estate Transfer Tax the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. Virginia imposes a real estate transfer tax on the sale of real property. virginia's current transfer tax rate is usually $3.50 per $1,000. Virginia’s transfer tax, which covers the transfer of property ownership, is. Does Virginia Have A Real Estate Transfer Tax.

From www.therealestategroupphilippines.com

Taxes and Title Transfer Process of Real Estate Properties This 2021 Does Virginia Have A Real Estate Transfer Tax the virginia state transfer tax is levied at a rate of $0.25 cents per $100 of the portion price or fair market value of. virginia's current transfer tax rate is usually $3.50 per $1,000. real estate transfer tax: Virginia imposes a real estate transfer tax on the sale of real property. a real estate transfer tax. Does Virginia Have A Real Estate Transfer Tax.